1

Start with the basics - instant TCFD metrics

Instantly calculate core TCFD statistics across your portfolios and individual holdings. Get a better understanding of relative performance and emissions hotspots which require further investigation.

2

Add financially-focused metrics

Carbon Spread (bps): Quantify the hidden risk of carbon emissions within a portfolio.

Carbon Risk Adjusted Earnings (CRAE) Score: Understand which holdings are contributing more than their fair share of emissions in a chosen portfolio.

3

Run NGFS climate scenarios - or create your own

What does a $400/tCO2e carbon tax mean for your portfolio? Or how will your performance differ under a 2050 vs 2070 Net Zero path?

Understand how your risk evolves under NGFS climate scenarios for emissions and carbon prices.

4

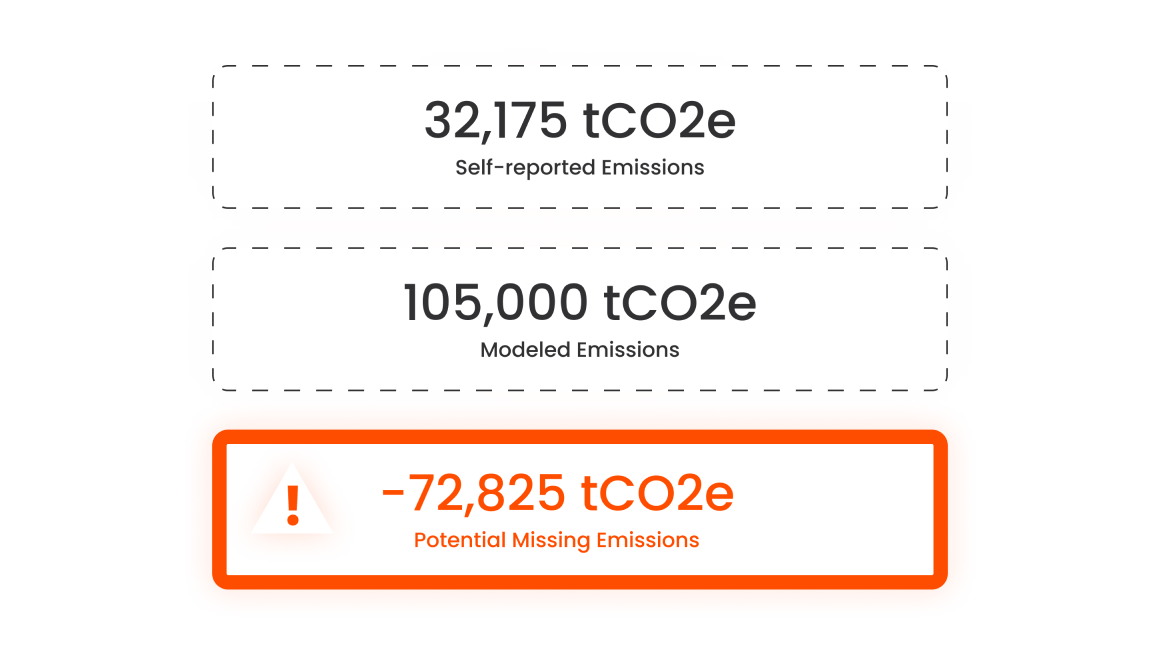

Identify hidden outliers

How likely is it that holding from a notoriously high-polluting industry is outperforming green firms in low-carbon verticals?

Our unique market-blindness indicators help you understand where self-reported emissions may be worth questioning.

5

Adjust weightings and holdings in a fund to understand the Carbon impact

Instantly see the carbon risk impact of changes in your portfolio. Add or remove holdings or adjust weightings and see the risk impact today and into the future.

6

Construct low Carbon and Carbon netural funds from the ground up

Design portfolios with your target level of carbon risk. Understand how different sectors perform as well as different companies within the same sector.

7

Hedge Carbon risk or go carbon neutral with verified offsets

Understand risk, adjust your portfolio, and act to manage remaining carbon risk by adding carbon offsets to your long-term holdings.